Battery Thermal Management System Market by Propulsion (BEV, PHEV, FCEV), Offering (BTMS With Battery, BTMS Without Battery), Technology (Active, Passive, Hybrid), Battery Type, Battery Capacity, Vehicle Type and Region - Forecast to 2030

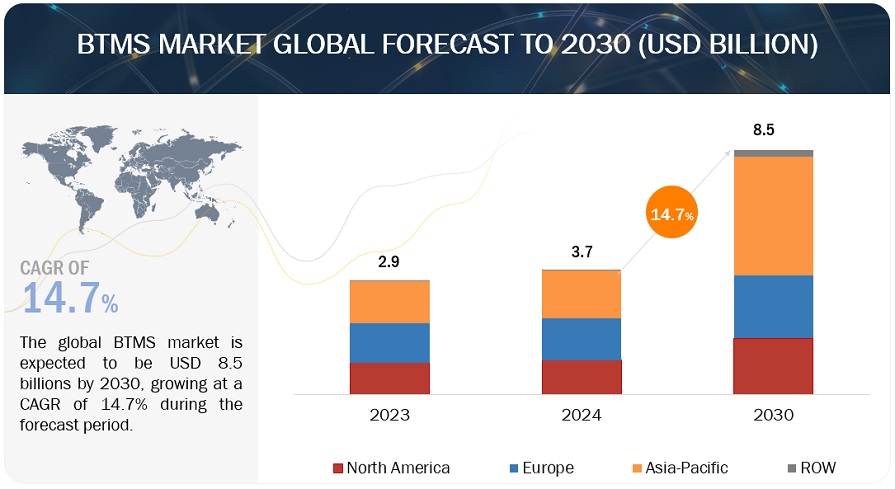

[400 Pages Report] The global battery thermal management systems market size is projected to grow from USD 3.7 billion in 2024 to USD 8.5 billion by 2030, at a CAGR of 14.7%. The BTMS market is witnessing robust growth driven by increasing demand for electric vehicles and innovation around battery technologies may drive the market for BTMS systems.

To know about the assumptions considered for the study, Request for Free Sample Report

To know about the assumptions considered for the study, download the pdf brochure

Driver: Innovation in EV battery system

Battery thermal management systems are integral to maximizing the performance and longevity of EV batteries, particularly in the context of significant advancements in battery technology. As innovations such as solid-state batteries and improvements in cathode chemistry reshape the landscape of EV batteries, thermal management becomes even more critical to ensure the efficient operation of these cutting-edge systems. Innovations in cathode chemistry, such as lithium nickel manganese cobalt oxide (NMC), lithium nickel cobalt aluminum oxide (NCA), and lithium iron phosphate (LFP), have led to higher energy densities and improved range in EV batteries. However, these advancements also bring challenges in terms of thermal management. For instance, the Tesla Model S uses LFP batteries. Tesla has developed a new battery design in which the cooling ribbons are now glued directly to the cooling ribbon, and the cooling ribbon spans a greater percentage of the cells' height. NMC batteries typically operate within a voltage range of 3.0–4.2 volts per cell. These have a nominal voltage of 3.6–3.7 volts per cell. NMC batteries use graphite anode and lithium compounds like Lithium Manganese Oxide (LiMn2O4) and Lithium Nickel Oxide (LiNiO2). Due to their current battery components, these batteries typically rely on air or liquid cooling.

Restraint: Complexities associated with design components

The design complexities in components used for a battery thermal management system involve a range of considerations to ensure optimal performance and safety. These complexities include selecting active, passive, or hybrid heat transfer solutions, such as forced air, liquid, or thermoelectric. Engineers must evaluate factors like heat dissipation, power consumption, flow rates, and thermal conductivity of coolants to regulate battery temperature effectively. Additionally, the design process involves modeling the detailed thermal behavior of the battery, selecting components, exploring different parameters, and optimizing the system's performance. Simulation tools like MATLAB and Simulink are utilized to analyze trade-offs, design controls, and assess the thermal impact of various design options. The system design also encompasses considerations like heat transfer paths, cooling plate connections, and thermal interface materials to represent the battery's thermal behavior accurately. Overall, the design of a battery thermal management system involves a comprehensive approach to ensure efficient operation and longevity of the battery under diverse operating conditions.

Opportunity: Growing potential of modular design

Modular design is a promising approach for developing next-generation battery thermal management systems (BTMS) that can improve performance, flexibility, and cost-effectiveness. There are some developments in this area, such as using mini-channel cooling plates with modular designs that can be easily integrated into battery packs. These plates allow for targeted cooling of individual battery cells or modules, improving temperature uniformity. The modular nature enables scalability to different pack sizes and configurations. Optimizing the structural layout of modular BTMS components can further improve performance. Studies have used topology optimization to design efficient liquid cooling plates. Incorporating modular vortex generators or perforated plates into air-cooled racks enhances airflow and heat transfer. Continued research in this area will further advance next-generation BTMS.

Challenge: Irregular operation of BTMS in extreme temperature

Battery thermal management systems (BTMS) face a tough challenge dealing with varied temperatures worldwide. In hot places like the Middle East or parts of Australia, batteries get even hotter, which can cause damage and reduce their lifespan. To fix this, BTMS needs robust cooling systems with larger radiators or multi-stage setups to keep temperatures consistent. Similarly, in cold climates such as Canada or Scandinavia, batteries don't work either, leading to less range and efficiency. To solve this, BTMS uses heating elements and waste heat to keep batteries working correctly. Finding the right balance between cooling and heating is challenging. BTMS must work well in climates, irrespective of the region, to keep batteries functioning smoothly

BTMS Market: Ecosystem

The battery thermal management system market ecosystem encompasses a diverse array of players, each contributing to developing and delivering cutting-edge solutions. The key participants include OEMs, Tier 1 suppliers, BTMS component suppliers, material suppliers, and software & control system providers. Within this ecosystem, tier 1 suppliers are central in designing and producing a wide range of BTMS solutions based on the battery type and its applications. BTMS component suppliers ensure the efficient supply of components needed for BTMS, connecting tier 1 suppliers with end-users across various industries. Additionally, material suppliers supply essential elements for the operation & maintenance of BTMS. Collaboration among these stakeholders is vital for driving innovation and meeting the evolving needs of BTMS end users. Through strategic partnerships and collaborations, the BTMS market ecosystem strives to deliver reliable, efficient, and cost-effective solutions to enhance productivity and the safety of EV batteries.

BTMS without Battery segment is estimated to exhibit the fastest growth in global BTMS market

BTMS for batteries are procured separately by the OEMs. It depends on the characteristics and configuration that the OEMs want to use in their batteries. The integration of BTMS with batteries in the automotive industry is a critical aspect of ensuring the optimal performance and longevity of lithium-based batteries. OEMs, such as Tesla, BYD, Nissan, and VW (Audi), have taken ownership of the design elements of BTMS, even though components are often procured from external sources. While Tesla and BYD are notable for having their own battery pack integration facilities, other OEMs often rely on Tier 1 suppliers for integration. These OEMs integrate the BTMS into the battery pack at their facilities, reflecting a trend where OEMs are more involved in the design and control of these systems. Luxury car makers, such as Mercedes Benz, have also set up 8 battery factories with existing partners (CATL) across Europe, the US, and China and one with a new partner. Similarly, BMW also plans to build giga factories with partners such as CATL, Northvolt, and Samsung SDi. With such steps by key OEMs, they have full control over the design. This trend will continue in the future, and there is a chance that these OEMs might include BTMS components such as cooling plates and thermal sensors while developing their own battery pack. However, for legacy OEMs such as GM, Ford, and Tata, the integration of BTMS typically relies on Tier 1 suppliers. This shift towards OEMs taking more control over BTMS design highlights the importance of efficient thermal management in enhancing battery performance and safety in electric vehicles.

Hybrid technology segment is expected to have significant growth BTMS market during the forecast period

Hybrid systems in BTMS combine multiple thermal management techniques to achieve optimal temperature regulation within EV batteries. These techniques often include active liquid cooling, passive cooling, and phase-change materials (PCMs). The integration of these methods enables dynamic and adaptive thermal management, catering to various operational conditions and environmental factors. Hybrid BTMS can be designed as a closed-loop system with feedback control to maintain the battery pack within an optimal temperature range under varying operating conditions and loads. The selection of cooling methods depends on factors such as battery chemistry, pack size, operating environment, and cost constraints. A hybrid approach provides more flexibility to balance performance, complexity, and cost. For instance, BYD uses a hybrid system for its EV models, such as the Dolphine and Yuan Plus. They use direct heating and cooling systems to keep their battery performance at optimal range. Additionally, hybrid BTMS solutions are integral to stationary energy storage systems, grid-scale batteries, and renewable energy integration projects, where efficient thermal management is essential for maximizing performance and reliability. For instance, in November 2023, Stellantis NV (Netherlands) constructed the North America Battery Technology Centre at the Automotive Research and Development Centre (ARDC) in Ontario, Canada. This center represents a significant milestone in the advancement of battery technology within the automotive industry.

Commercial Vehicles segment is expected to see highest growth in BTMS market during the forecast period

The commercial vehicle segment includes LCVs, buses, and trucks. The nature of these vehicles limits their production volumes and growth rates as they are used in specific applications such as logistics. On the other hand, LCVs have come a long way from having bare-essential features to full-blown utility vehicles that can be used for passengers as well as commercial purposes. In EVs, including commercial ones, batteries are susceptible to overheating during operation, especially under heavy loads or in extreme environmental conditions. A robust BTMS helps regulate the temperature of the battery pack, preventing it from getting too hot or too cold, which can degrade battery life and compromise vehicle performance. For instance, companies such as Volvo Group, BYD, Daimler AG, Traton Group, and others are developing or already have EV models for commercial use, integrating effective BTMS in their production lines. The BYD K8 60-foot electric bus utilizes an active liquid cooling system for its BTMS, in which a pump forces a coolant liquid (usually a water-glycol mixture) through a network of channels embedded within the battery pack.

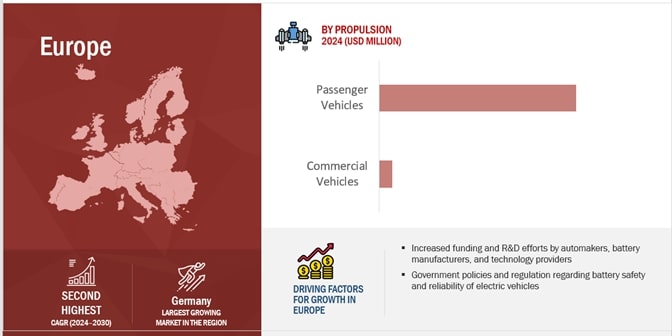

“The Europe BTMS market is projected to become second largest by 2030.”

The European BTMS market is considered for France, Germany, the Netherlands, Norway, Sweden, the UK, and the Rest of Europe. Europe has stringent emission regulation standards. The European region's robust support for EVs, exemplified by significant government incentives, has led to a substantial increase in EV demand. This surge is particularly pronounced due to the ambitious emissions reduction goals set by Europe, aiming for an 80% decrease in CO2 emissions by 2030–2035. To achieve these targets, governments across Europe are actively subsidizing EV infrastructure and related components such as battery thermal systems, thermal sensors, and cooling plates, signaling a sustained focus on electric mobility in the foreseeable future. Within this landscape, the presence of prominent OEMs such as Continental AG (Germany), Robert Bosch GMBH (Germany), Valeo (France), and others offers fertile ground for the growth of the BTMS market in the region. In April 2024, the collaboration between BMW Group and Rimac Technology represents a significant step forward in the advancement of electric mobility. By leveraging Rimac's innovative BTMS technology, BMW aims to further solidify its position as a leader in providing its EVs with advanced BTMS solutions, offering customers unparalleled performance, range, and reliability in their EVs.

Key Market Players

The global BTMS market is dominated by major players such as Robert Bosch (Germany), Gentherm (US), Continental AG (Germany), Denso (Japan), BorgWarner Inc. (US), Webasto Group (Germany), among others.

Get online access to the report on the World's First Market Intelligence Cloud

- Easy to Download Historical Data & Forecast Numbers

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

Request Sample Scope of the Report

Get online access to the report on the World's First Market Intelligence Cloud

- Easy to Download Historical Data & Forecast Numbers

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

|

Report Metric |

Details |

|

Market size available for years |

2019–2030 |

|

Base year considered |

2024 |

|

Forecast period |

2024-2030 |

|

Forecast units |

Value (USD Million) |

|

Segments covered |

By Technology, Battery Capacity, Vehilcle type, Propulsion Type, Battery type, By offering and Region |

|

Geographies covered |

Asia Pacific, Europe, North America, and Rest Of The World |

|

Companies Covered |

Robert Bosch (Germany), Gentherm (US), Continental AG (Germany), Denso (Japan), BorgWarner Inc. (US), Webasto Group (Germany) |

This research report categorizes the BTMS market based on Technology Type, Battery Type, Battery Capacity, Propulsion, offering, Vehicle Type, and region

BTMS Market, By Vehicle Type:

- Passeneger Vehicles

- Commercial Vehicles

BTMS Market, By Battery Type:

- Li-ion

- Solid state

BTMS Market, By Propulsion Type:

- BEV

- FCEV

- PHEV

BTMS Market, By Battery Capacity:

- <100 KWH

- 100-200 KWH

- 200-500 KWH

- >500 KWH

BTMS Market, By offering:

- BTMS with Battery

- BTMS without Battery

BTMS Market, By Region

- Asia Pacific

- Europe

- North America

- Rest Of The World

BTMS Market, By Technology

- Active technology

- Passive Technology

- Hybrid Technology

Recent Developments

- In February 2024, Denso Corporation's collaboration with Betterfrost and the Ontario Vehicle Innovation Network represents a significant advancement in addressing the range limitations of EVs in extreme heat and cold.

- In February 2024, The acquisition betwwen Modine and Scott Springfield Manufacturing to diversify its product offerings by incorporating air-handling units into its portfolio.

- In February 2024, The partnership between GM and LG Chem underscores a commitment to advancing state-of-the-art battery technology. By prioritizing thermal management solutions, they aim to address key challenges such as battery degradation, overheating, and safety concerns.

- In January 2024, The partnership between Bosch’s Rexroth and Modine emphasizes the development of customized thermal management solutions tailored to the specific requirements and operating conditions of off-highway applications.

- In January 2024, The joint venture between BorWarner Inc. and Shaanxi Fast Auto Drive Group helps address key challenges faced by electric CVs, such as range limitations, charging times, and overall reliability.

- In January 2024, The partnership between ZutaCore and Valeo represents a significant step forward in advancing battery thermal management systems for EVs.

- In December 2023, The strategic partnership between Valeo and FUCHS represents a significant collaboration in the pursuit of excellence and innovation in automotive thermal management.

- In November 2023, The partnership between LG Chem and SNU aims to leverage their respective expertise to innovate new materials that will optimize the thermal management of batteries.

- In October 2023, Continental acquired KINEXON (Germany) to address key challenges regarding battery operation in dynamic and demanding environments.

- In July 2023, The partnership between MAHLE and ProLogium represents a strategic collaboration to advance the state-of-the-art in thermal management solutions for solid-state batteries.

- In June 2023, The agreements between Carrar, Gentherm, and Röchling represent a strategic alliance to advance battery thermal management systems for electric and hybrid vehicles.

- In May 2023, Carrar and Gentherm have entered into a strategic collaboration to deliver advanced two-phase immersion thermal management systems for electric vehicle battery modules.

Frequently Asked Questions (FAQ):

What is the current size of the global BTMS market?

The global BTMS market size is estimated to be USD 3.7 billion in 2024 and expected to reach USD 8.5 billion by 2030.

Who are the winners in the global BTMS market?

The BTMS market is dominated by The major players such as Robert Bosch (Germany), Gentherm (US), Continental AG (Germany), Denso (Japan), BorgWarner Inc. (US), Webasto Group (Germany), among others. These companies develop new products, adopt expansion strategies, and undertake collaborations, partnerships, and mergers & acquisitions to gain traction in the BTMS market.

What are the new market trends impacting the growth of the BTMS market?

The new market trend such as Modularization of BTMS and innovation around its components like cooling plates, battery packs, thermal sensors, and others.

Which region is expected to be the largest market during the forecast period?

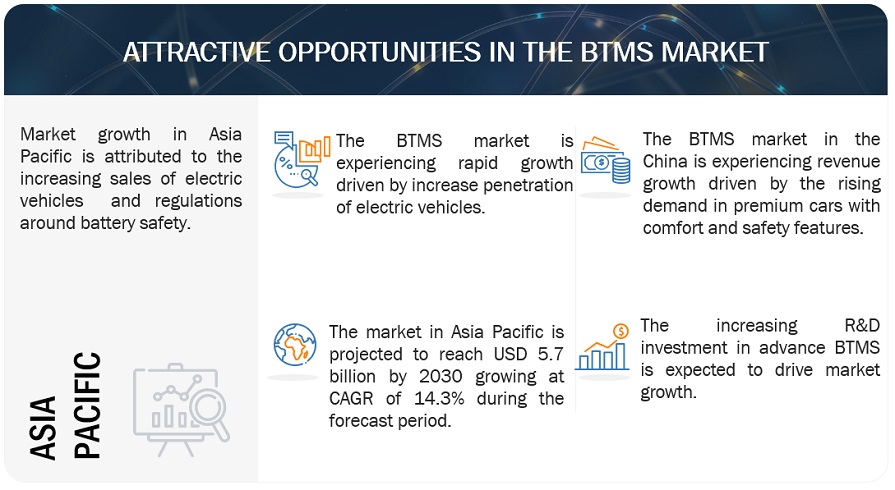

Asia Pacific is anticipated to be the largest market in the BTMS market due to the increasing sales of electric and mid-segement passenger vehicles.

What is the total CAGR expected to be recorded for the BTMS market during 2024-2030?

The CAGR is expected to record a CAGR of 14.7% from 2024-2030 in terms of value. .

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

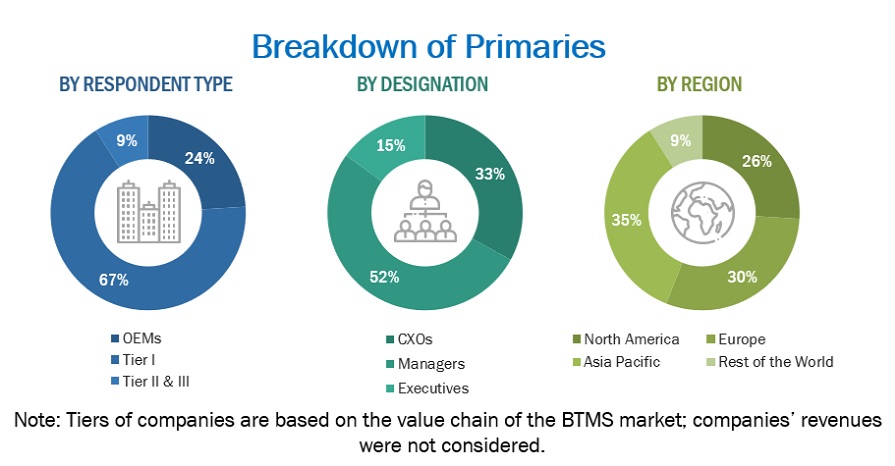

The research study involved extensive secondary sources, such as company annual reports/presentations, industry association publications, magazine articles, directories, technical handbooks, World Economic Outlook, trade websites, technical articles, and databases, to identify and collect information on the BTMS market. Primary sources, such as experts from related industries, automobile OEMs, and suppliers, were interviewed to obtain and verify critical information and assess the growth prospects and market estimations.

Secondary Research

Secondary sources for this research study include corporate filings, such as annual reports, investor presentations, and financial statements; trade, business, and professional associations; whitepapers, marklines, and the OICA (International Organization of Motor Vehicle Manufacturers); certified publications; articles by recognized authors; directories; and databases. Secondary data was collected and analyzed to determine the overall market size, further validated by primary research.

Primary Research

Extensive primary research was conducted after understanding the BTMS market scenario through secondary research. Several primary interviews were conducted with market experts from the demand side (vehicle manufacturers, country-level government associations, and trade associations) and the supply side (BTMS manufacturers, component providers, and system integrators). The regions considered for the research include North America, Europe, the Asia Pacific, and the Rest of the World. Approximately 17% and 83% of primary interviews were conducted from the demand and supply sides. Primary data was collected through questionnaires, emails, and telephonic interviews. In the canvassing of primaries, various departments within organizations, such as sales, operations, and marketing, were covered to provide a holistic viewpoint in this report.

After interacting with industry experts, brief sessions were conducted with highly experienced independent consultants to reinforce the findings from the primaries. This, along with the in-house subject matter experts’ opinions, led to the findings described in this report.

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

A detailed market estimation approach was followed to estimate and validate the volume and value of the BTMS market and other submarkets, as mentioned below.

- Key players in the BTMS market were identified through secondary research. Their global market share was determined through primary and secondary research.

- The research methodology included studying the annual and quarterly financial reports & regulatory filings of major market players and interviews with industry experts for detailed market insights.

- All major penetration rates, percentage shares, splits, and breakdowns for the BTMS market across end users were determined using secondary sources and verified through primary sources.

- All key macro indicators affecting the revenue growth of the market segments and subsegments were accounted for, viewed in extensive detail, verified through primary research, and analyzed to get the validated and verified quantitative & qualitative data.

- The gathered market data was consolidated and added with detailed inputs, analyzed, and presented in this report.

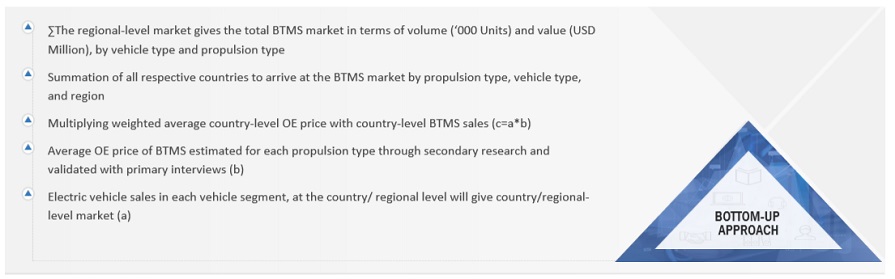

Global BTMS Market Size: Bottom-Up Approach

To know about the assumptions considered for the study, Request for Free Sample Report

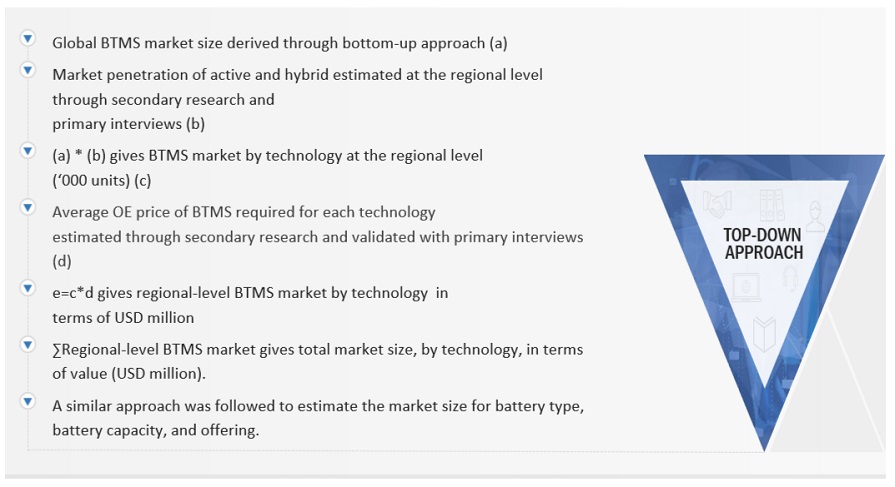

Global BTMS Market Size: Top-Down Approach

Data Triangulation

After arriving at the overall market size through the aforementioned methodology, the BTMS market was split into several segments and subsegments. The data triangulation procedure was employed, wherever applicable, to complete the overall market engineering process and arrive at the exact market value for key segments and subsegments. The extrapolated market data was triangulated by studying various macro indicators and regional trends from both the demand- and supply-side participants.

Market Definition

BTMS Market: According to Grayson Thermal Systems, BTMS encompasses technologies and solutions that help regulate and control the temperature of batteries in electric vehicles, specifically battery electric (BEV), plug-in hybrid electric vehicles (PHEVs), and fuel cell electric (FCEV) vehicles. These systems help maintain optimal battery performance, range, and service life by ensuring that batteries operate within a specified temperature range. BTMS includes various components such as cooling systems, heating systems, insulation materials, sensors, and control algorithms to efficiently manage battery temperatures under different operating conditions.

Key Stakeholders

- Automobile Original Equipment Manufacturers (OEM)

- Automotive electronics system integrators

- Automotive Parts Manufacturers’ Association (APMA)

- Electric Drive Transportation Association (EDTA)

- Electric power infrastructure suppliers

- Electric Vehicle Association of Asia Pacific (EVAAP)

- Electric vehicle hardware suppliers

- Manufacturers of automotive wireless charging systems for EVs

- Manufacturers of electric vehicle charging system

- Society of Manufacturers of Electric Vehicles (SMEV)

- World Electric Vehicle Association (WEVA)

Report Objectives

- To segment and forecast the size of the battery thermal management system (BTMS) market in terms of volume (thousand units) and value (USD million)

- To define, describe, and forecast the size of the BTMS market based on technology type, battery type, vehicle type, battery capacity, offering, propulsion, and region

- To analyze regional markets for growth trends, prospects, and their contribution to the overall market

- To segment and forecast the market size, by technology (active, passive, and hybrid)

- To segment and forecast the market size, by battery type (lithium-ion and solid state)

- To segment and forecast the market size, by vehicle type (passenger vehicles and commercial vehicles)

- To segment and forecast the market size, by battery capacity (<100 kWh, 100–200 kWh, 200–500 kWh, and >500 kWh)

- To segment and forecast the market size, by offering (BTMS with battery and BTMS without battery)

- To segment and forecast the market size, by propulsion type (battery electric vehicles, plug-in hybrid electric vehicles, and fuel cell electric vehicles)

- To forecast the market size by region (North America, Europe, Asia Pacific, and Rest of the World)

- To analyze technological developments impacting the market

- To provide detailed information about the major factors influencing the market growth (drivers, challenges, restraints, and opportunities)

- To strategically analyze the market, considering individual growth trends, prospects, and contributions to the total market

- To study the following concerning the market (Value chain analysis, Ecosystem analysis, Technology analysis, HS code, Case study analysis, patent analysis, Regulatory analysis, Key stakeholders and buying criteria, and key conferences and events.)

- To estimate the following with respect to the BTMS market (Pricing analysis, propulsion type, by region, and market ranking analysis).

- To strategically profile key players and comprehensively analyze their market ranking and core competencies

- To analyze the impact of the recession on the market

- To track and analyze competitive developments such as deals, product developments, expansions, and other developments carried out by key industry participants.

Available Customizations

With the given market data, MarketsandMarkets offers customizations in accordance to the company’s specific needs.

- BTMS MARKET, BY VEHICLE TYPE AT THE COUNTRY LEVEL (FOR COUNTRIES NOT COVERED IN THE REPORT)

COMPANY INFORMATION:

- Profiling of additional market players (Up to 5)

Growth opportunities and latent adjacency in Battery Thermal Management System Market